Those who earn income by being in employment in Japan and those who has a residential address in Japan as of January 1st of the year are required to pay tax. This includes foreign nationals residing in Japan.

This page provides an explanation on Income Tax and Resident Tax.

With Regards to Tax in Japan

- Japan National Tax Agency (National Tax Agency Site)

Income Tax

Income Tax refers to the tax levied on an individual’s income received between January 1st to December 31st.

Taxpayer and the Scope of Taxable Income

The scope of taxation for Income Tax differs according to the classification of resident status.

Income tax is imposed on the salary and remuneration paid by the university regardless of the category.

Other than that, in some cases, international students may be entitled to deductions and exemptions under the “Exemptions for Working Students” and “Tax Treaties” act.

For residents, the treatment under domestic law differs from the treatment under tax treaties. The “address” stated in the table below refers to the “individual’s home of residence” and is determined by where the person’s center of residence is located. For details, please refer to “Classification of Residents and Nonresidents (National Tax Agency Website)” *only available in Japanese .

| Category | Description | Scope of Taxation |

| Resident (other than non-permanent residents) | Those with an address in Japan, or those who have had an residential address in Japan for more than 1 year consecutively. | All income including foreign-sourced income |

|---|---|---|

| Resident (non-permanent residents) | Those among “Resident” category who are not of Japanese nationality, and who have had an address/residential address in Japan for a combined total of 5 years or less in the past 10 years. | ①Income other than foreign-sourced income and ②Foreign-sourced income paid in Japan or remitted from overseas to Japan. |

| Non-resident | Those who do not fall under the “Resident” or “non-permanent resident” category (such as those with an address overseas etc) | Only for Japan-sourced income, such as income received from employment in Japan, or remuneration received from any service rendered in Japan etc. |

※ Reference :

Categorization of Resident and Non-resident (Japan National Tax Agency Web *Japanese language only)

With Regards to Tax Exemptions for Students

- Exemptions for Working Student(National Tax Agency Website *Japanese language only)

- Salary from Student’s Part-time Job (National Tax Agency Website *Japanese language only)

- Tax treaty

Income Tax Withholding System (Tax Withheld at Source)

Income Tax Witholding System refers to the witholding of tax by the payer of certain income stipulated in the Income Tax Law (such as salaries, bonuses, retirement allowances, remuneration and fees) by way of deducting the amount of income tax from the amount of income paid, and paying it to the government. (for the period between 2013 and 2037,

special income tax for reconstruction is withheld along with income tax and is paid together with withheld income tax)

By prescribing to the Income Tax Witholding System, salaried employees are able to make income tax payments progressively in small amounts by deducting the amount to be paid from their monthly salary. As the amount withheld is calculated based on a rough estimate, the actual income tax based on “taxable income” minus deductions (e.g., insurance premiums deduction, spouse’s exemption) and income tax already collected will be adjusted by year-end adjustment when the salary is paid at the end of the year.

As a general rule, Income Tax Withholding System applies to employees salaried by Tohoku University, and income tax will be deducted from their monthly salaries. Other than ineligible employees, year-end adjustment will be done when salary is paid in December.

Please be sure refer to this link ※Internal access only for the handling of withholding tax on travel expenses and honorariums of external parties (from within Japan or overseas) that was invited by Tohoku University.

Also refer to : Understanding Your Payslip

With Regards to Income Tax Withholding

- Outline of Japan’s Withholding Tax System Related to Salary (The 2022 edition)(Japan National Tax Agency Website)

- Handling of Withholding Tax on Travel Expenses and Honorariums(Finance Department, Tohoku University Administration Bureau)※Internal access only

As a general rule, income tax is calculated following the calculation below:

| ① | Income – Expenses =Amount of Income(A) |

|---|---|

| ② | Amount of Income(A)- Any Deductions = Amount of Taxable Income(B) |

| ③ | Amount of taxable income(B)× Tax Rate**tax rate increases with the amount taxable income earned (B) |

Caution : Regarding Tax Withholding of Non-resident

For foreign nationals under ther “Resident” category, income tax will be withheld based on Table of Tax Withheld, and year-end adjustment will be done to calculate the annual income tax amount, same as Japanese nationals in the same category.

However, for those under “Non-Resident” category, tax will be withheld at a fixed 20.42% rate, and there will be no year end adjustment done for this group.

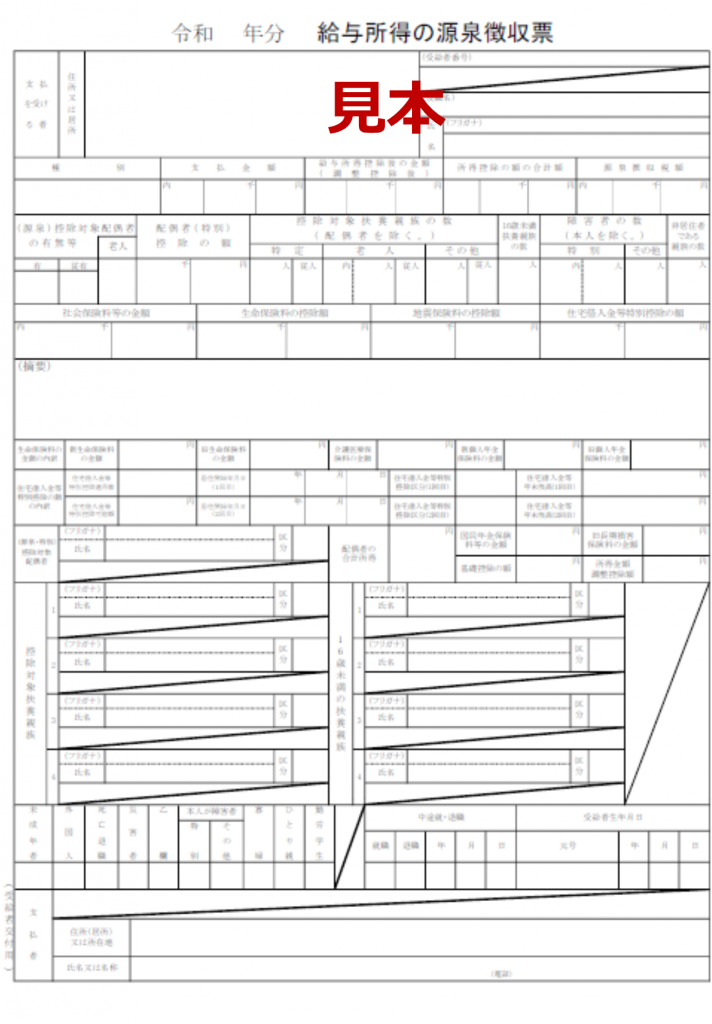

Certificate of Tax Withheld

Certificate of Tax Withheld refers to a document that lists the total amount of salary, bonuses, etc. paid by a place of employment in a year, the amount of income tax paid from that amount, and various deductions.

This document is distributed by the employer (the University) after the annual year-end adjustment (around January of the following year) or about one month after the separation from employment, and is required when changing jobs, filing a tax return, or when proof of income is needed.

Year-end Adjustment

The year-end adjustment is a calculation that is done to match the total amount of tax withheld in a year and the actual amount of annual income tax. In Tohoku University, tax adjustment calculation is done in November or when an employee leave Tohoku University employment.

As a general rule, those who are eligible for the year-end adjustment are those who had submitted the “declaration for dependent allowance” to the university. However, those who meet certain conditions, such as those whose salary income exceeds 20 million yen, are not eligible for the year-end adjustment.

Foreign nationals under the “Resident” category who receives remuneration from Tohoku University and submits “declaration for dependent allowance” are also elligible for year-end tax adjustment. (However foreign nationals under “non-resident” category are not eligible for the year-end adjustment)

The forms to be filled out for the year end adjustment will be distributed by the PIC in the respective department (except for Real Estate Income Special Exemption Report Form). However, in the event that employees need to declare deductions, they are required to submit various certificate (original copy).

※ Reference : Various Types of Deductions (Exemptions) (Japan National Tax Agency Website*Japanese language only)

Documents to be submitted (Example from 2022) ※Please attach Japanese translation for documents in foreign language

| Types of Exemption | Circumstance That Requires Submission | Documents Required |

|---|---|---|

Application of (Change in) Exemption for Dependents of Employment Income Earner. | Only if the spouse or dependent relatives fall under the “non-resident” category. | Document proving family relationship (either ① or ②) ①Documents issued by Japan or local government (copy of passport of the relative concerned with attached family register) ②Documents issued by a foreign government or local public entities (those that contain the name, date of birth, and address or residence of the relative concerned) |

Application of Basic Exemption of Employment Income Earner and Application for Exemption for Spouse of Employment Income Earner and Application for Exemption of Amount of Income Adjustment. | Only if the spouse or dependent relatives fall under the “non-resident” category. | [Document proving family relationship] + either ① or ② as below ①The documents of financial institutions or their copies, which clarify that you made payments to the spouse through exchange transactions conducted by the financial institutions. ②The documents from credit card companies or their copies which clarify that the spouse purchased goods or the like using credit cards issued by the credit card companies and that the spouse received amounts equivalent to the purchases from you. |

| Application for Deduction for Insurance Premiums for Employment Income Earner. | If you are enrolled under the following insurance: Life Insurance, Earthquake Insurance, Social Insurance, Individual Defined Contribution Pension etc. | Certificate issued by the insurance company. *enter the “annual premium” in the amount column of the declaration form, (not the “certified amount paid” on the certificate) |

| Application for Special Exemption for Home Acquisition (The form will be sent from the tax office to those eligible in the first year of filing a tax return, etc.) | If you are have a housing loan from a financial institution, etc. | Certificate of year-end balance of loan issued by financial institution, etc. |

Tax Returns

The income tax return is a procedure to calculate the amount of income generated during the year from January 1 to December 31 of each year and the amount of income tax, etc. on that income, and to settle any excess or deficiency. The process is done in February or March of the following year in which income is generated. When one leaves Japan(after year-end adjustment) tax return must be done before leaving the country as necessary.

Regarding Tax Returns

- Filing Tax Returns (Japan National Tax Agency)

- About Tax Returns(Japan National Tax Agency *Japanese language only)

Eligible Person

Most salaried employees will carry out year-end adjustment, and therfore are not required to file for tax returns. However, salaried employees who meet certain conditions must file tax returns. Please refer to the below pages for more details:

Reference:

- Those Required to File Tax Returns(Japan National Tax Agency *Japanese language only)

- Salaried Employees Who Are Required to File Tax Returns (Japan National Tax Agency *Japanese language only)

- Filing Tax Returns Manual for Foreign Nationals For Year 2021 (Japan National Tax Agency)

Caution

- There are cases where tax returns must be filed for the purpose of income tax calculation when you leave Japan. If you leave your current employment and will be leaving Japan, please check with the relevant payroll department with regards to the year-end adjustment and income tax calculation. (if tax filing is required, the procedure is different from resident tax, and must be done at the tax office).

Tax Treaty

A tax treaty refers to a treaty concluded between Japan (the source country) and one’s country of residence (refering to the country where one pays taxes, not nationality) for the purpose of eliminating double taxation and preventing tax evasion.

Professors, foreign students, etc. who have come to Japan and wish to obtain tax exemption on their income, etc. must complete the required procedures. In addition, if the individual has obtained an exemption from income tax in Japan by applying to a tax treaty, they are required to report and pay income tax on the remuneration earned in Japan to the tax authorities of their country of residence based on the tax system of their country of residence. Applicant of tax treaty are required to check with the tax authorities in each country regarding the procedures required in each country themselves.

As a general rule, Income Tax Withholding System applies to employees salaried by Tohoku University, and income tax will be deducted from their monthly salaries. Other than ineligible employees, year-end adjustment will be done when salary is paid in December.

Please refer to this link ※Internal access only for the handling of withholding tax on travel expenses and honorariums of external parties (from within Japan or overseas) that was invited by Tohoku University.

Regarding Tax Treaty

- Information Pertaining to Tax Treaty(Japan National Tax Agency *Japanese language only)

- Handling of Withholding Tax on Travel Expenses and Honorariums(Finance Department, Tohoku University Administration Bureau)※Internal access only

Confirmation of Your Eligibility

In the case where a person wishes to receive a reduction or exemption based on the application of the provisions of a tax treaty, the person who wishes to apply for the tax treaty shall be required to determine the following:

(1) Whether he/she is a resident of a country with which the tax treaty is concluded, and if so,

(2) Whether the tax treaty contains privilege provisions [as an example: in the case of teachers: “exemption from income tax and special income tax for remuneration and salary for free professionals, entertainers, sportsmen, short-term visitors”, (for non-resident applicant) and “remuneration for education or research,” etc.; and in the case of foreign students: “benefits for students and business graduates,” etc.] as well as the applicable conditions for such exemption.

Caution:

The contents of tax treaties differ depending on the countries with which they are concluded. When applying tax treaties, please carefully check the details of the applicable tax treaties.

Reference : The List of Japan’s Tax Conventions (Japan Ministry of Finance Website)

Application Procedure

If you wish to apply for this exemption, prepare two copies of the notification form for each payer of remuneration, grants, etc., and submit it to the tax office through the payer ( if the University is the payer, application will be submitted to the tax office through the university) after you have arrived in Japan, up to 1 day before receving the payment.

Please be advised that there are documents that must be obtained prior to the date of payment (e.g., prove of residence of the recipient country, etc.). For that reason, please check with the tax office well in advance to determine whether or not you are eligible to apply.

Caution:

The required documents, particularly “Prove of Residence” may take a long time (2-3 months) to be issued in your country of residence. Please start the process of compiling all necessary documents to be issued in your country of residence well in advance of your departure to Japan.

Resident Tax (Individual Resident Tax)

Resident Tax includes municipal inhabitant tax and prefectural inhabitant tax, and is levied by the municipality/prefecture on those who have a domicile in that municipality/prefecture as of January 1st. Foreign residents who have a domicile in Japan as of January 1st and who receive a certain amount of salary, etc., are required to pay the tax to the municipality in which they live. However, if their earned income from the previous year is lower than the exemption limit, or if they are subject to a tax treaty and had followed the prescribed procedures, they will qualify for either resident tax exemption or reduction.

Regarding Individual Resident Tax, Tax Exemption and Tax Reduction

- Regarding Individual Resident Tax for Foreign Nationals(Ministry of Internal Afffairs and Communication Website)

- Income Tax Exemption for Persons with Disabilities, Municipal/Prefectural Tax Deductions and Reductions(Sendai City Website *Japanese Only)

Caution

- If you have an address in Japan on January 1st, and if your earned income from the previous year is above tax exemption limit, resident tax will incur even if you leave Japan on January 2nd onwards. Failure to pay your resident tax may result in the possibility of your extension of stay in Japan being denied.

Resident Tax Returns

Those who fall under the below categories are not required to file for resident tax return.

Those who have an address in Japan on January 1st, who DO NOT fall under the below categories are required to file for resident tax return. This includes those without any earned income in the previous year (including international students who receives scholarship or allowance from home).

Please take note that failure to file resident tax returns may result in your tax exemptions certificate not being issued, and an increase in the premiums to be paid for government-provided services that are calculated based on individual municipal tax such as national insurance.

- Those who had submitted income tax retun; and their dependent relatives.

- Those whose only source of income is their salary, and are subject to year-end adjustments; and their dependent relatives.

- Those whose only source of income is from public pensions, etc. and have no additional deductions other than those shown on the withholding tax form.

- Those whose only source of income is from public pensions, and that the the pension in come is less than 1,050,000 yen for those below 65 years old, and less than 1,550,000 yen for those above 65 years old.

Reference: Individual Municipal and Prefectural Tax Returns (Sendai City Website *Japanese language only)

Resident Tax Payment Method

- Special Tax Collection (Auto-deduction from Monthly Salary): The employer pays the annual tax amount, divided into 12 installments, to the local government by deducting the resident tax from the monthly salary from June each year until May of the following year. Those who receives remuneration from Tohoku University will follow this tax collection system, and are not required to make the resident tax payment to their municipality as long as they are employed by the University.

- Normal Tax Collection (Self-payment) A Resident Tax Payment Slip will be sent out by the municipality every year in June. Bring the Resident Tax Payment Slip along with the amount money mentioned in the slip to payment facilities to make the payment. In Sendai, the municipility tax can be paid through bank transfer, smartphone payment app, credit card, convenient store etc.

※Reference:

- Resident Tax Payment and Other Questions(Sendai City Website*Japanese language only)

- Resident Tax (Sendai City Website)

Caution (For those who will be leaving Japan after leaving their employment)

- Those who leave their employment in Tohoku University are no longer eligible for the Special Tax Collection method, and therefore are required to pay the Resident Tax through the Normal Tax Collection method. However, they can also request the university to deduct the outstanding balance of any unpaid resident tax from their final salary or severence pay. If you leave Tohoku University employment, please check with the relevant payroll department with regards to the Resident Tax and Income Tax Payment calculation.

- Those who will be leaving Japan between January and June (before the tax notice postcards are sent out) and whose income from the previous year is above the tax exemption limit , are required to either complete the tax payment procedure or complete the tax representative appointment procedure before they leave Japan.

- Those who will be leaving Japan between June and December (after the tax notice postcards had been sent out), whose income from the previous year is above the tax exemption limit , are required to complete the payment before they leave Japan. If they have completed the payment before they leave Japan, no further procedure is required, however, those who are unable to complete the payment before they leave Japan are required to complete the tax representative appointment procedure before they leave Japan.

- Reference: Individual Resident Tax Payment Procedures for Those Leaving Japan (Sendai City Website)

Tax Representative

If a taxpayer becomes a non-resident and is unable to complete the tax payment procedure themselves, they are required to entrust the procedures related to tax payment (receipt of documents, tax payment, receipt of refund, etc.) to a third party (i.e: tax representative)

If a person is unable to pay their income tax, resident tax, etc. before they leave Japan, they are required to appoint a tax representative from among residents of Japan to complete the tax procedures on their behalf. They are also required to submit a tax representative appointment notice form (“Inhabitant Tax Agent Appointment and Change Application Form”) to their municipal office for Resident Tax, and to the Tax Office in charge of their area of residence for Income Tax.

※Resident Tax: Individual Resident Tax Payment Procedures for Those Leaving Japan(Sendai City Website)

Income Tax:Income tax information for an individual who will leave Japan (National Tax Agency Website)