Contents

National Pension

Mid to long term residents living in Japan aged between 20 and 60, including those with foreign nationalities (those who are issued a residence card), are required by law to join the National Pension Plan and pay premiums.

Overview of Japan National Pension System

Japan National Pension System (Japan National Pension Service Website)

Enrollment Process

The insured persons under the National Pension system are categorized to three types according to their status as follows::

| Category | Description | Enrollment Process |

|---|---|---|

| Category 1 Insured Person | All registered residents of Japan aged 20 to 59 years who are not Category II or III insured persons. | Apply in person at the National Pension counter at your local city or ward office. |

| Category 2 Insured Person | Employed person who is enrolled into Employees’ Pension Insurance system or Mutual Aid Associations. | Performed by the company/ business owner |

| Category 3 Insured Person | Dependent spouse of Category II Insured Person’s dependent spouse aged 20 to 59 years. | Performed by the company/ business owner |

Category I (Students, JSPS Fellows, Researcher with Cultural Activities Residence Status)

If you are a student, a recipient of the JSPS Postdoctoral Fellowship for Research in Japan, or a researcher whose residence status is “Cultural Activities,” you fall under Category I Insured Persons.

You must submit an application form referred to as “Application to Enroll in National Pension as Category Ⅰ Insured Person” (国民年金被保険者関係届書(申出書)) at the Health Insurance and Pension Division (Hoken Nenkinka) of your local ward office (bring your Residence Card and Social Security and Tax Number notification card).

If you are newly arriving in Japan, please submit the enrollment application form at your ward office’s Health Insurance and Pension Division after completing moving-in procedures.*Please enclose a copy of your residence card (front and back). The International Support Center provides assistance in completing the enrolment procedures at the ward office. International students and researchers can apply for this service if they require assistance with completing this procedure.

Upon Turning 20

You will be sent an Application to Enroll in National Pension (国民年金被保険者関係届書(申出書)) by the Japan Pension Service in the month before your 20th birthday. Enter the necessary information, and submit it at your ward office’s Health Insurance and Pension Division (bring your Student ID).

When you do this, you can also apply for the Deferred Payment System for National Pension Contributions (Hokenryo no Nofu Yuyo Seido) and Special Payment System for Students (Gakusei Nofu Tokurei Seido).

Reference:

20歳になったら、どのような手続きが必要ですか(Japan Pension Service Web *Japanese language only)

Category II (Those with employment status at TU)

Researchers and faculty members with employment status at Tohoku University will fall under Category II Insured persons. The pension enrollment procedure for this group will be conducted by the university after the start of employment. The dependants of Category II fall under the Category III Insured persons. The pension enrollment procedure for this group will be conducted by the university after the start of their supporter’s employment at the university.

Category III (Dependants of Category II)

The dependants of Category II fall under the Category III Insured persons. The pension enrollment procedure for this group will be conducted by the university after the start of their supporter’s employment at the university.

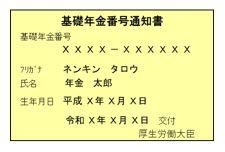

Pension Handbook (Nenkin Techo)

Up until March 2022, a pension handbook is issued upon completion of the pension enrollment procedures to receive a regular pension. Once a handbook is issued, it is valid throughout the lifetime of the member, so please keep it in a safe place.

From April 2022 onwards, a “Notice of Basic Pension Number Card” is issued for those who completes the procedures to acquire the insured person qualification and enrolled into the pension system for the first time.

※Please be advised that the Notice of Basic Pension Number Card will not be issued to those who were already issued with a pension handbook. For that reason, please continue to ensure the safekeeping of your pension handbook.

Contribution Payment Exemption System / Special Payment System for Students

If a person finds it difficult to pay pension premiums for reasons such as a low income, they can apply for the Pension Premium Exemption System or the Special Payment System for Students at the local ward office.

Special payment system for students

The Special Payment System for Students allows the applicant to postpone payment of premiums until they graduate, joins employment and can afford to pay the contribution premiums (degree students only). Although the period during which the special exception is granted is included in the 25-year qualifying period for receiving the basic old-age pension, it is not reflected in the amount of the pension.

Application/Procedure

Those who are eligible for the special payment system can pick up and submit the Application for the Special Payment System for Students (国民年金保険料学生納付特例申請書) at the Education and Student Support Center. (Attach a copy of your Student ID on an A4-size paper.)

The Japan Pension Service will screen your exemption application and send you a notification of the screening result (postcard) about 3 months after submission. Applications for exemptions are accepted every year from April until March of the following year. Exemptions must be re-applied for every academic year (academic year in Japan is from April – March).

Exemption/Deferment

Research students/special auditing students/special research students are not eligible for the “Special Payment System for Students”. However, they can apply for an exemption (Nofu Menjo) or deferment (Nofu Yuyo). Please see the Japan Pension Service website.

Application/Procedure

Submit a National Pension Payment Exemption/Deferment Application (国民年金保険料免除・納付猶予申請書)(carbon copy form) at your ward office’s Health Insurance and Pension Division.

The Japan Pension Service will screen your exemption application, and send you a notification of approval or rejection about 3 months after submission. Applications for exemptions are accepted every year from July until June of the following year.

For details on deferment and special payment system:

- Deferred Payment System for National Pension Contributions (Hokenryo no Nofu Yuyo Seido) (Japan National Pension Service Web)

- Special Payment System for Students (Gakusei Nofu Tokurei Seido) (Japan National Pension Service Web)

Caution:

If your status at the university changes from “research student/special auditing students/special research students” to “degree student,” you must apply separately for the aforementioned Special Payment System for Students.

Paying Insurance Premiums

Payment for insurance premiums can be made via cash payment at convenience stores, automatic deduction from your account, or paid with credit cards. Please see the Japan Pension Service(Japanese) website for details.

For those with employment status at the university (as well as their dependents), the premiums will be directly deducted from their monthly salaries.

Lump-Sum Withdrawal Payments for Foreign Nationals

Foreign nationals who have been paying into the National Pension System can receive a lump-sum withdrawal payment once they cease to be a resident of Japan.

The withdrawal application must be submitted within two years of their departure from Japan or their submission of a “notification of moving” to the City/Ward Office, and the applicants must satisfy all 5 requirements as below:

- Applicants must no longer have a residential address in Japan (have already left Japan, or have submitted a “notification of moving” to the ward office.

- Applicants must not have a Japanese nationality.

- Applicants must have paid into the National Pension Plan for at least 6 months.

- Applicants was never eligible to receive a pension (including disability allowance).

- Applicant must have submitted the withdrawal application within two years of their disenrollment from the pension system.

Application/Procedure

- Request a Lump-sum Withdrawal Payment claim form before leaving Japan.

- After leaving Japan, fill out the claim form and send it by airmail to the Japan Pension Service business center (located in Suginami ward, Tokyo)

For details on lump-sum withdrawal payments:

- Lump-sum Withdrawal Payments (Japan Pension Service)

- Lump-sum Withdrawal Payments (MEXT Mutual Aid Association)

Inquiries concerning the National Pension Plan

Please contact your local ward office or Social Insurance Office for more information concerning the National Pension plan.

Japan Pension Service Miyagi office (Japanese language only)

Employees’ Pension Insurance

Employee Pension Insurance is a Public Insurance System for company employees / public officers aged below 70 years old who are employed in places of employments that are covered by the Employees’ Pension Insurance.

As insured person in the Employees’ Pension Insurance are also enrolled in the National Pension System through the Employees’ Pension Insurance, they will receive both the “National Pension (Basic Pension)” and the “Employees’ Pension.”

Regarding the Employees’ Pension Insurance

- Employees’ Health Insurance System and Employees’ Pension Insurance System(Japan National Pension Service Web)

- 適用事業所と被保険者(Japan National Pension Service Web*Japanese language only)

Enrollment Process

The enrollment process will be done by your place of employment. Please fill out and submit the documents provided by the payroll staff of your place of employment

| Category | Description |

|---|---|

| Insured Person | 〇Those under 70 years of age who are regularly employed at places of employment covered by the Employees’ Pension Insurance are insured person regardless of nationality, gender or whether they receive a pension. 〇Part-time employees (part-time employees, associate employees) who are in a regular employment relationship with a place of business are also insured. Those whose prescribed working hours per week and prescribed working days per month are three-fourths or more of regular workers engaged in similar work at the same office are also eligible. In addition, the scope of application will be expanded from 01 October 2022, and those who fall under all of the following will be insured. 1. Prescribed weekly working hours are 20 hours or more. 2. Monthly wage is 88,000 yen or more. 3. Expected to be employed for more than 2 months. 4. Not a student. 参考:社会保険適用拡大特設サイト (Japan MHLW Web *Japanese language only) |

Paying Insurance Premiums

The insurance premium for Employees’ Pension Insurance are paid by the place of employment directly to the Japan Pension Service. The Employees’ Pension Insurance premium of an insured person are borne by both the insured and the employer. For those who are employed by Tohoku University, insurance premium will be directly deducted from monthly Salary.

・Reference:Understanding Your Payslip

Exemption System

Insured person are exempted from paying welfare pension insurance premiums during maternity leave and childcare leave. The exemption application process will be made by the employer (If you are employed by Tohoku University, the University will be carry out the procedures related to application of exemption).

・Reference:Exemption from Employees’ Pension Premiums (during maternity / childcare leave) *Japanese language only

厚生年金保険料等の免除 (Japan Pension Service Web *Japanese language only)

Employees’ Health Insurance System and Employees’ Pension Insurance System (Japan Pension Service Web)

Lump-Sum Withdrawal Payments for Foreign Nationals

Foreign nationals who have been paying into the National Pension System for more than 6 months and who has not met the eligibility period for the old-age basic pension can receive a lump-sum withdrawal payment once they cease to be a resident of Japan.

The withdrawal application must be submitted within two years of their departure from Japan or their submission of a “notification of moving” to the City/Ward Office, and the applicants must satisfy all 5 requirements as below:

- Applicants must no longer have a residential address in Japan (have already left Japan, or have submitted a “notification of moving” to the ward office.

- Applicants must not have a Japanese nationality.

- Applicants must have paid into the National Pension Plan for at least 6 months.

- Applicants was never eligible to receive a pension (including disability allowance).

- Applicant must have submitted the withdrawal application within two years of their disenrollment from the pension system.

Application/Procedure

- Please request a Lump-Sum Withdrawal Payment claim form before leaving Japan.

2. After leaving Japan, fill out the necessary information on the claim form, and send it by airmail to the Social Insurance Service Center (located in Suginami ward, Tokyo).

List of Reference Links

- Japan Pension Service Official Website

- Japan National Pension System Various Language Pamphlets (Japan Pension Service website)

Social Security Agreement

With globalization and various kinds of international exchanges, employees who are dispatched from Japan to work in foreign countries or vice versa often face the issues below:

- Dual Coverage

- Having to be enrolled in both the social insurance system of their own country and the country they were sent to work in, and as a result being obliged to pay contributions to the public pension systems of both countries.

- Secure of Pension Entitlement

- Employees sent to other countries for short periods are often unable to fulfill the pension entitlement of the country due to their insufficient periods of coverage.

For that reason, Japan and their partner countries have concluded a social security agreement in order to prevent the issue of dual coverage, as well as making fulfilling period of coverage in both countries more easily achievable by totalizing periods of coverage under both countries so as to fulfil the qualifying periods required to receive pension benefits from each country.

The countries that have signed the agreement are (Germany, the United Kingdom, South Korea, the United States, Belgium, France, Canada, Australia, the Netherlands, the Czech Republic, Spain, Ireland, Brazil, Switzerland, Hungary, India, Luxembourg, the Philippines, Slovakia, China, Finland, Sweden and Italy), 23 of which are in force (as of June 1, 2022).

For details on Social Security Agreement

- International Social Security Agreement (Japan Pension Service Web)

- If You Leave the Agreement Country to Work in Japan (Japan Pension Service Web)

- Procedures When You are Working in Japan (Japan Pension Service Web)

Enrollment Process

Under the social security agreement, those who are dispatched to work overseas temporarily (not more than 5 years in general) are exempted from joining the social security system of the country in which they work in, and will continue to be covered only by the social security system of their country of origin.

For example, if a person (whose country of origin is covered under the agreement) was temporarily dispatched to work in Japan they can continue to be covered by the social security system of their country of origin, and be exempted from joining the social security system in Japan. In order to be exempted from joining the social security system in Japan, they must obtain a “Certificate of Coverage” in their home country before coming to Japan, and present the certificate at their place of work at the start of their employment.

The coverage of the social security agreements differ depending on the system of the country with which the agreement is concluded. For details of the coverage treatment under the agreement with each country, please refer to the Social Security Agreement from the Japan National Pension website. Click on each country to learn more about the coverage treatment.

※The agreements with the UK, South Korea, Italy (not yet in force) and China are only for “prevention of dual payment of insurance premiums”.

Caution

- It may take up to 2-3 months for the certificate of coverage to be issued. For that reason, foreign nationals joining Tohoku University’s employment who wishes to enrol into the Social Security Agreement are strongly encouraged to confirm their eligibility and complete all necessary procedures well in advance of their arrival in Japan. (The same applies to proof of residency in the country of residence of the person arriving in Japan, which is necessary for the application of the tax treaty.)

Support With Enrolling into National Pension System

The International Support Center provides assistance to newly arriving international students and researchers with the enrollment into the National Pension System.

Kindly apply for the support service from the button below:

*The enrolment procedure for the Employees’ Pension Insurance will be done by the employees’ host department respectively.